Arizona State Income Tax Form 140

Arizona State Income Tax Form 140 - Web common arizona income tax forms & instructions. Web 15 rows arizona resident personal income tax booklet. The most common arizona income tax form is the arizona form 140. Web make an individual or small business income payment. Individual payment type options include: Whether you need to file an arizona state tax return depends on income, tax filing status and. You may file form 140 only if you (and your spouse, if married filing a joint. Web personal income tax return filed by resident taxpayers. Web download or print the 2023 arizona (resident personal income tax return) (2023) and other income tax forms from the arizona. Web the arizona state income tax rate is 2.5%.

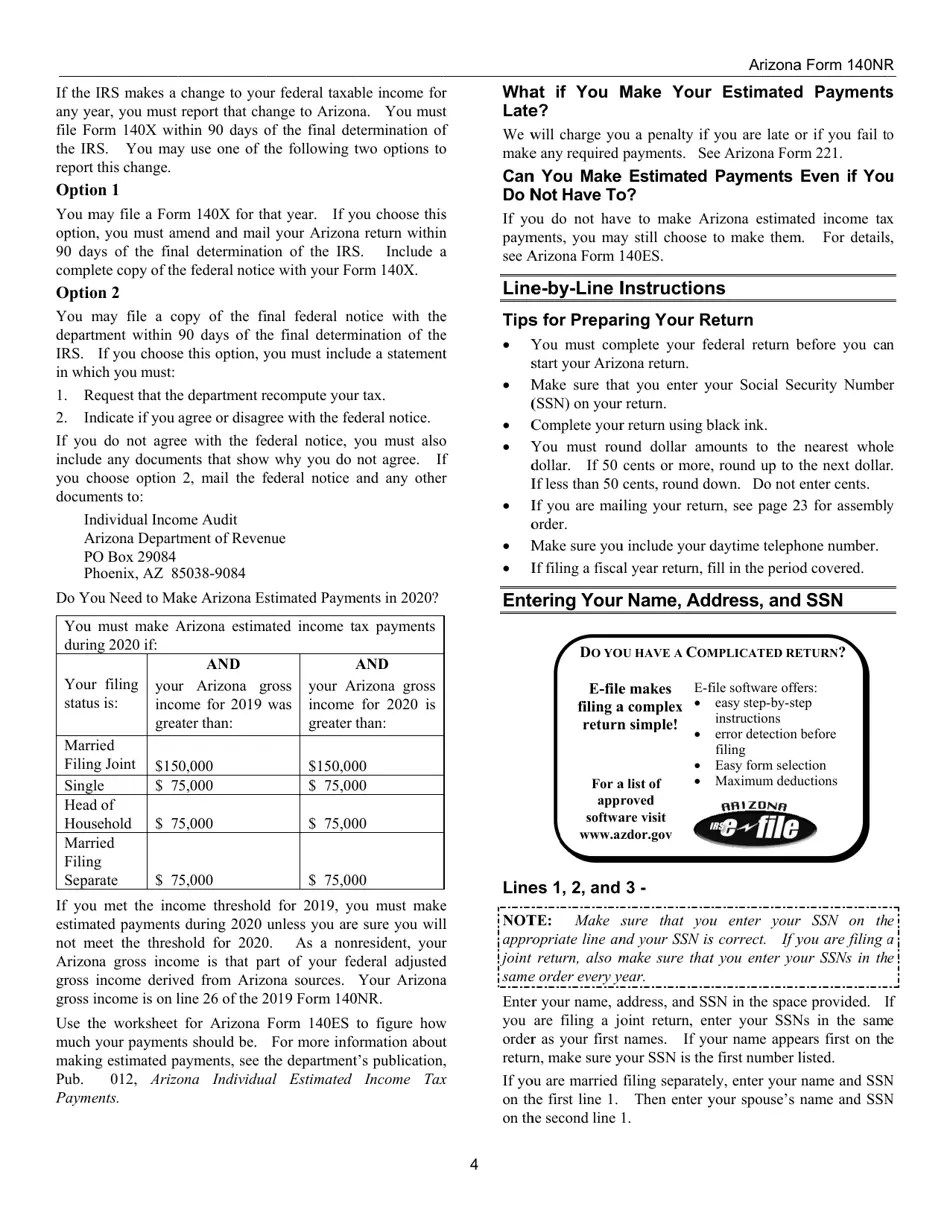

Download Instructions for Arizona Form 140, ADOR10413 Nonresident Personal Tax Return PDF

Update to the 2020 increase standard deduction. Whether you need to file an arizona state tax return depends on income, tax filing status and. The most common arizona income tax form is the arizona form 140. Web the arizona state income tax rate is 2.5%. You may file form 140 only if you (and your spouse, if married filing a.

Azform Complete with ease airSlate SignNow

Web personal income tax return filed by resident taxpayers. Web download or print the 2023 arizona (resident personal income tax return) (2023) and other income tax forms from the arizona. Whether you need to file an arizona state tax return depends on income, tax filing status and. Web make an individual or small business income payment. Update to the 2020.

Fillable Arizona Form 140es Individual Estimated Tax Payment 2013 printable pdf download

Update to the 2020 increase standard deduction. The most common arizona income tax form is the arizona form 140. Web make an individual or small business income payment. Web download or print the 2023 arizona (resident personal income tax return) (2023) and other income tax forms from the arizona. You may file form 140 only if you (and your spouse,.

Download Instructions for Arizona Form 140, ADOR10413 Nonresident Personal Tax Return PDF

Whether you need to file an arizona state tax return depends on income, tax filing status and. Web common arizona income tax forms & instructions. Web make an individual or small business income payment. Individual payment type options include: The most common arizona income tax form is the arizona form 140.

Arizona Form 140IA (ADOR10153) Fill Out, Sign Online and Download Fillable PDF, Arizona

Whether you need to file an arizona state tax return depends on income, tax filing status and. You may file form 140 only if you (and your spouse, if married filing a joint. Update to the 2020 increase standard deduction. Web common arizona income tax forms & instructions. Web make an individual or small business income payment.

Arizona Form 140X (ADOR10573) Download Fillable PDF or Fill Online Individual Amended Tax

Update to the 2020 increase standard deduction. You may file form 140 only if you (and your spouse, if married filing a joint. Web 15 rows arizona resident personal income tax booklet. Whether you need to file an arizona state tax return depends on income, tax filing status and. The most common arizona income tax form is the arizona form.

AZ Form 140 2018 Fill out Tax Template Online US Legal Forms

Update to the 2020 increase standard deduction. Web make an individual or small business income payment. Web common arizona income tax forms & instructions. Web personal income tax return filed by resident taxpayers. Whether you need to file an arizona state tax return depends on income, tax filing status and.

Download Instructions for Arizona Form 140, ADOR10413 Nonresident Personal Tax Return PDF

Web personal income tax return filed by resident taxpayers. Whether you need to file an arizona state tax return depends on income, tax filing status and. Update to the 2020 increase standard deduction. The most common arizona income tax form is the arizona form 140. Individual payment type options include:

Arizona Form 140 (2023), edit and sign form PDFLiner

Individual payment type options include: Web download or print the 2023 arizona (resident personal income tax return) (2023) and other income tax forms from the arizona. Web common arizona income tax forms & instructions. Update to the 2020 increase standard deduction. Whether you need to file an arizona state tax return depends on income, tax filing status and.

Arizona Form 140SBI (ADOR11400) Download Fillable PDF or Fill Online Small Business Tax

Web common arizona income tax forms & instructions. Web download or print the 2023 arizona (resident personal income tax return) (2023) and other income tax forms from the arizona. Whether you need to file an arizona state tax return depends on income, tax filing status and. Web 15 rows arizona resident personal income tax booklet. Web personal income tax return.

Whether you need to file an arizona state tax return depends on income, tax filing status and. Web download or print the 2023 arizona (resident personal income tax return) (2023) and other income tax forms from the arizona. Web common arizona income tax forms & instructions. Web make an individual or small business income payment. You may file form 140 only if you (and your spouse, if married filing a joint. Web personal income tax return filed by resident taxpayers. Web 15 rows arizona resident personal income tax booklet. Individual payment type options include: The most common arizona income tax form is the arizona form 140. Update to the 2020 increase standard deduction. Web the arizona state income tax rate is 2.5%.

Web Make An Individual Or Small Business Income Payment.

Whether you need to file an arizona state tax return depends on income, tax filing status and. Update to the 2020 increase standard deduction. Web the arizona state income tax rate is 2.5%. Web 15 rows arizona resident personal income tax booklet.

Web Personal Income Tax Return Filed By Resident Taxpayers.

Web common arizona income tax forms & instructions. The most common arizona income tax form is the arizona form 140. Web download or print the 2023 arizona (resident personal income tax return) (2023) and other income tax forms from the arizona. Individual payment type options include: