Can Form 5227 Be Electronically Filed

Can Form 5227 Be Electronically Filed - Web under final regulations (t.d. Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227. Can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed? Web it covers everything from general instructions to specific steps for filling out each part of the form, ensuring. 9972) issued in february 2023, filers are required to file form 5227 electronically if they file 10 or more.

Form 5227 ≡ Fill Out Printable PDF Forms Online

Web under final regulations (t.d. Web it covers everything from general instructions to specific steps for filling out each part of the form, ensuring. 9972) issued in february 2023, filers are required to file form 5227 electronically if they file 10 or more. Web you can electronically file a pooled income or charitable lead trust return with form 1041 and.

5227 instructions Fill out & sign online DocHub

Web it covers everything from general instructions to specific steps for filling out each part of the form, ensuring. Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227. Can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed? 9972) issued in february.

Can Form W9 be Signed Electronically? Printable W9 Form 2023 (Updated Version)

Web under final regulations (t.d. Web it covers everything from general instructions to specific steps for filling out each part of the form, ensuring. Can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed? 9972) issued in february 2023, filers are required to file form 5227 electronically if they file 10 or.

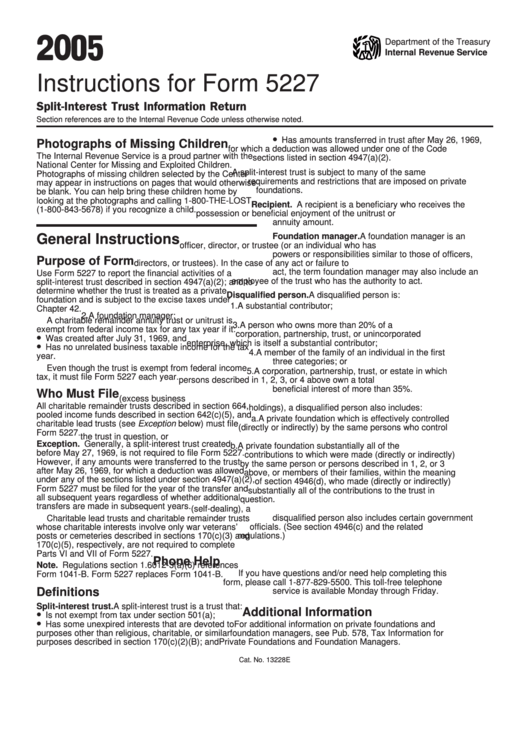

Download Instructions for IRS Form 5227 SplitInterest Trust Information Return PDF, 2018

9972) issued in february 2023, filers are required to file form 5227 electronically if they file 10 or more. Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227. Can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed? Web it covers everything.

Instructions For Form 5227 printable pdf download

9972) issued in february 2023, filers are required to file form 5227 electronically if they file 10 or more. Web it covers everything from general instructions to specific steps for filling out each part of the form, ensuring. Web under final regulations (t.d. Can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically.

Instructions For Form 5227 2016 printable pdf download

Web under final regulations (t.d. Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227. 9972) issued in february 2023, filers are required to file form 5227 electronically if they file 10 or more. Can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically.

Instructions For Form 5227 printable pdf download

9972) issued in february 2023, filers are required to file form 5227 electronically if they file 10 or more. Web under final regulations (t.d. Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227. Web it covers everything from general instructions to specific steps for filling out each part of the.

Instructions For Form 5227 SplitInterest Trust Information Return 1994 printable pdf download

9972) issued in february 2023, filers are required to file form 5227 electronically if they file 10 or more. Web under final regulations (t.d. Web it covers everything from general instructions to specific steps for filling out each part of the form, ensuring. Web you can electronically file a pooled income or charitable lead trust return with form 1041 and.

Instructions For Form 5227 printable pdf download

9972) issued in february 2023, filers are required to file form 5227 electronically if they file 10 or more. Can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed? Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227. Web under final regulations.

Instructions For Form 5227 printable pdf download

Web it covers everything from general instructions to specific steps for filling out each part of the form, ensuring. Can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed? Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227. Web under final regulations.

Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227. 9972) issued in february 2023, filers are required to file form 5227 electronically if they file 10 or more. Web it covers everything from general instructions to specific steps for filling out each part of the form, ensuring. Can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed? Web under final regulations (t.d.

Web It Covers Everything From General Instructions To Specific Steps For Filling Out Each Part Of The Form, Ensuring.

Web under final regulations (t.d. Can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed? 9972) issued in february 2023, filers are required to file form 5227 electronically if they file 10 or more. Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227.