Form 3514 Business Code Must Be Entered

Form 3514 Business Code Must Be Entered - Effective january 1, 2021, taxpayers who have an individual. If you don't have a sein or business. Web learn how to claim the refundable california eitc, yctc, and fytc by filing a california income tax return and attaching form ftb. Web california is requesting form 3514 line 18 wanting business information. Web how do i enter a business code on ca state form 3514, when i don't have a federal 1040 sch c? Web 603 rows for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for. Web the form 3514 requests a business code, business license number and sein. Web this business code can be found on any of your business activities not only on a schedule c. Web for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for. How do i clear this to efile?

Instructions for Form 990T (2016) Internal Revenue Service

Web 603 rows for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for. Web for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for. Web learn how to claim the refundable california eitc, yctc, and fytc by filing a california income tax.

Va Life Insurance Application Form Financial Report

If you don't have a sein or business. Web how do i enter a business code on ca state form 3514, when i don't have a federal 1040 sch c? Web the form 3514 requests a business code, business license number and sein. Web 603 rows for example, a taxpayer may be classified as an independent contractor for federal purposes,.

AARP TaxAide WA District 18 Schedule C Business Codes

Web how do i enter a business code on ca state form 3514, when i don't have a federal 1040 sch c? Web the form 3514 requests a business code, business license number and sein. It could refer to a. Web for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for..

Employer settlement on 1099misc. TT making it self employed

Effective january 1, 2021, taxpayers who have an individual. It could refer to a. Web the form 3514 requests a business code, business license number and sein. If you don't have a sein or business. Web how do i enter a business code on ca state form 3514, when i don't have a federal 1040 sch c?

Ftb3514 20152024 Form Fill Out and Sign Printable PDF Template airSlate SignNow

Web learn how to claim the refundable california eitc, yctc, and fytc by filing a california income tax return and attaching form ftb. Web this business code can be found on any of your business activities not only on a schedule c. It could refer to a. Web the form 3514 requests a business code, business license number and sein..

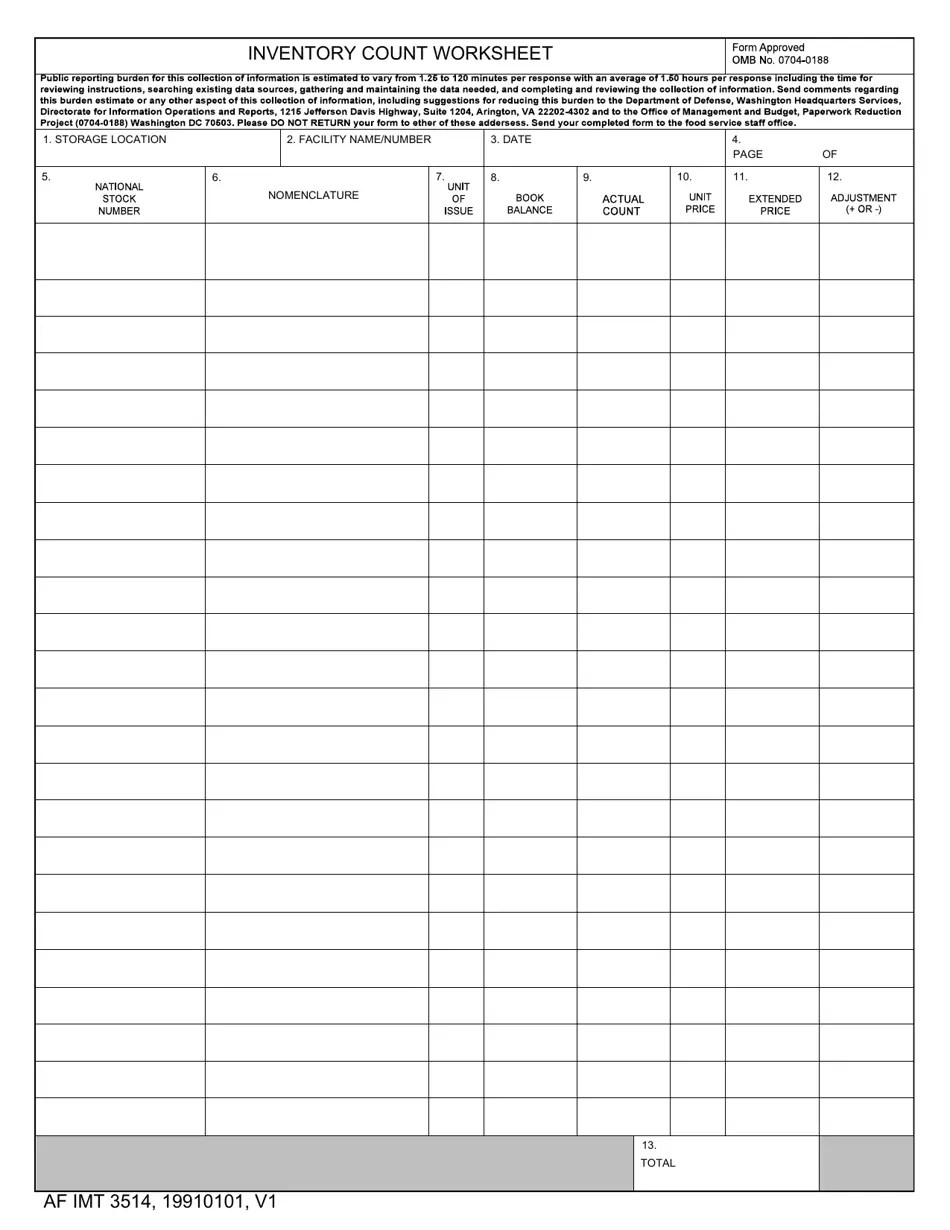

AF IMT Form 3514 Fill Out, Sign Online and Download Fillable PDF Templateroller

Web the form 3514 requests a business code, business license number and sein. Web this business code can be found on any of your business activities not only on a schedule c. It could refer to a. Web california is requesting form 3514 line 18 wanting business information. Web for example, a taxpayer may be classified as an independent contractor.

3514 Business Code 20222024 Form Fill Out and Sign Printable PDF Template airSlate SignNow

Web california is requesting form 3514 line 18 wanting business information. Web the form 3514 requests a business code, business license number and sein. Web learn how to claim the refundable california eitc, yctc, and fytc by filing a california income tax return and attaching form ftb. If you don't have a sein or business. How do i clear this.

20202024 Form FDA 3514 Fill Online, Printable, Fillable, Blank pdfFiller

Web 603 rows for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for. Web learn how to claim the refundable california eitc, yctc, and fytc by filing a california income tax return and attaching form ftb. How do i clear this to efile? If you don't have a sein or business..

2016 Form 3514 California Earned Tax Credit Edit, Fill, Sign Online Handypdf

Web learn how to claim the refundable california eitc, yctc, and fytc by filing a california income tax return and attaching form ftb. Web how do i enter a business code on ca state form 3514, when i don't have a federal 1040 sch c? Web for example, a taxpayer may be classified as an independent contractor for federal purposes,.

Fill Free fillable 2016 Instructions for Form FTB 3514 (California) PDF form

Web how do i enter a business code on ca state form 3514, when i don't have a federal 1040 sch c? If you don't have a sein or business. Web learn how to claim the refundable california eitc, yctc, and fytc by filing a california income tax return and attaching form ftb. Effective january 1, 2021, taxpayers who have.

It could refer to a. Web this business code can be found on any of your business activities not only on a schedule c. Effective january 1, 2021, taxpayers who have an individual. How do i clear this to efile? Web how do i enter a business code on ca state form 3514, when i don't have a federal 1040 sch c? Web 603 rows for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for. If you don't have a sein or business. Web for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for. Web learn how to claim the refundable california eitc, yctc, and fytc by filing a california income tax return and attaching form ftb. Web california is requesting form 3514 line 18 wanting business information. Web the form 3514 requests a business code, business license number and sein.

If You Don't Have A Sein Or Business.

Web this business code can be found on any of your business activities not only on a schedule c. It could refer to a. Web 603 rows for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for. Web for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for.

How Do I Clear This To Efile?

Web the form 3514 requests a business code, business license number and sein. Web california is requesting form 3514 line 18 wanting business information. Web learn how to claim the refundable california eitc, yctc, and fytc by filing a california income tax return and attaching form ftb. Web how do i enter a business code on ca state form 3514, when i don't have a federal 1040 sch c?