Form 4549-A

Form 4549-A - Form 4549 is based on the examiner's findings. Web form 4549, income tax examination changes, is used for cases that result in: Normally, the irs will use the form for the initial. Web what happens after an irs audit? Web form 4549 irs audit reconsideration: Taxpayer can agree with the irs or. Web the irs uses form 4549 for one of two reasons: 1) to assess a tax for unfiled returns (sfr), 2) to reports its audit findings.

Form 4549A Tax Discrepancy Adjustments printable pdf download

Web form 4549 irs audit reconsideration: Form 4549 is based on the examiner's findings. Web the irs uses form 4549 for one of two reasons: Web form 4549, income tax examination changes, is used for cases that result in: Web what happens after an irs audit?

Form 4549 Tax Examination Changes Internal Revenue Service printable pdf download

Taxpayer can agree with the irs or. Normally, the irs will use the form for the initial. Web what happens after an irs audit? Web the irs uses form 4549 for one of two reasons: 1) to assess a tax for unfiled returns (sfr), 2) to reports its audit findings.

Irs Form 4549 ≡ Fill Out Printable PDF Forms Online

Web form 4549 irs audit reconsideration: 1) to assess a tax for unfiled returns (sfr), 2) to reports its audit findings. Web what happens after an irs audit? Taxpayer can agree with the irs or. Web the irs uses form 4549 for one of two reasons:

Tax Dictionary Form 4549, Tax Examination Changes H&R Block

Taxpayer can agree with the irs or. Web what happens after an irs audit? Normally, the irs will use the form for the initial. Web form 4549, income tax examination changes, is used for cases that result in: Web the irs uses form 4549 for one of two reasons:

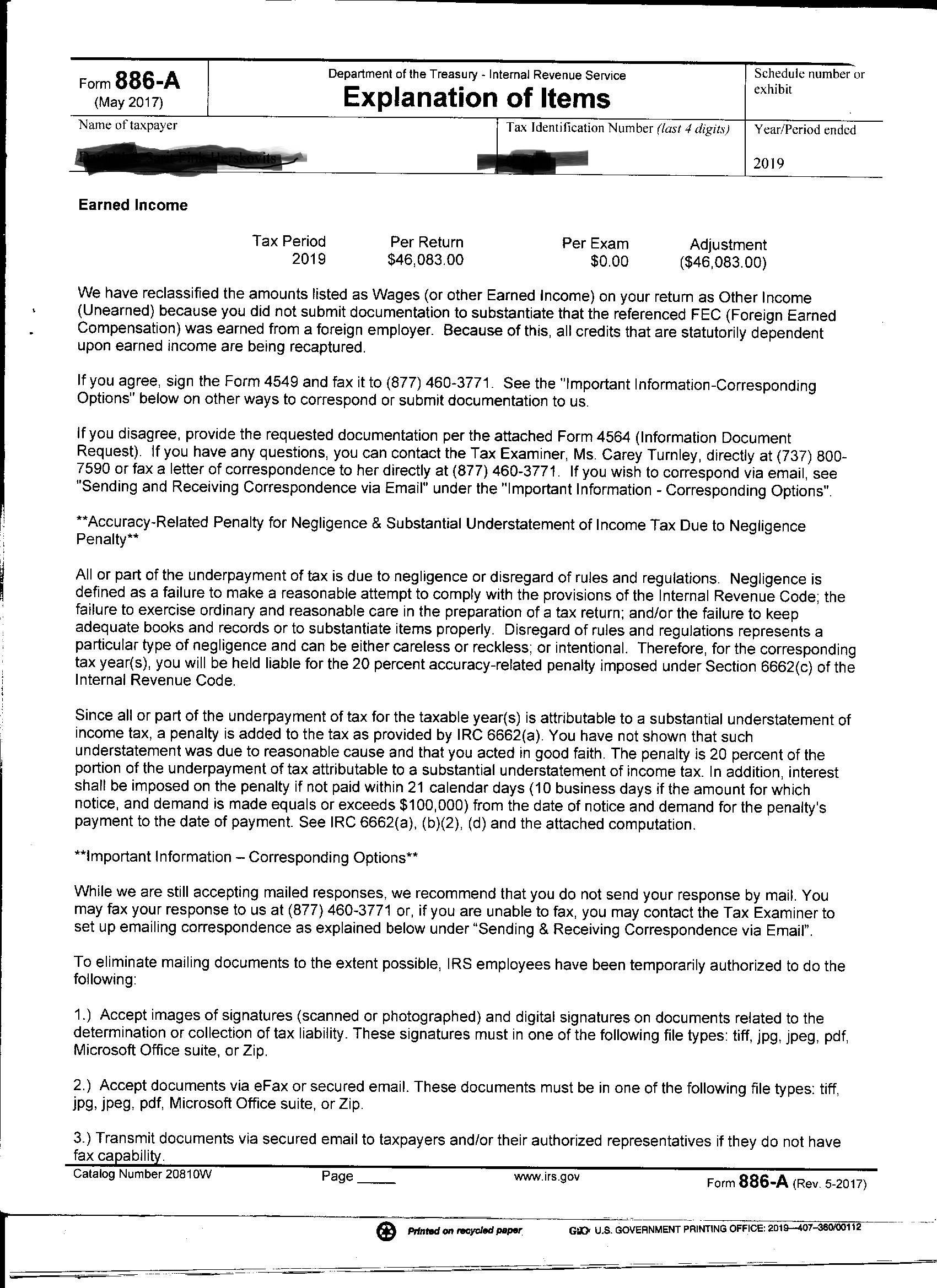

taxes How to resolve my unearned issue with the IRS? Personal Finance & Money Stack

Web the irs uses form 4549 for one of two reasons: Taxpayer can agree with the irs or. Normally, the irs will use the form for the initial. Web form 4549, income tax examination changes, is used for cases that result in: Web form 4549 irs audit reconsideration:

Form 4549A Tax Examination Changes printable pdf download

Normally, the irs will use the form for the initial. Web the irs uses form 4549 for one of two reasons: 1) to assess a tax for unfiled returns (sfr), 2) to reports its audit findings. Taxpayer can agree with the irs or. Web form 4549, income tax examination changes, is used for cases that result in:

4.10.8 Report Writing Internal Revenue Service

Web what happens after an irs audit? Web form 4549 irs audit reconsideration: 1) to assess a tax for unfiled returns (sfr), 2) to reports its audit findings. Web form 4549, income tax examination changes, is used for cases that result in: Form 4549 is based on the examiner's findings.

4.10.8 Report Writing Internal Revenue Service

Form 4549 is based on the examiner's findings. Web form 4549, income tax examination changes, is used for cases that result in: Normally, the irs will use the form for the initial. 1) to assess a tax for unfiled returns (sfr), 2) to reports its audit findings. Web form 4549 irs audit reconsideration:

Audit Letters 525, 692 and 1912 from the IRS

Web the irs uses form 4549 for one of two reasons: 1) to assess a tax for unfiled returns (sfr), 2) to reports its audit findings. Form 4549 is based on the examiner's findings. Taxpayer can agree with the irs or. Web form 4549, income tax examination changes, is used for cases that result in:

Form 4549 Response to IRS Determination

Web the irs uses form 4549 for one of two reasons: Web form 4549 irs audit reconsideration: 1) to assess a tax for unfiled returns (sfr), 2) to reports its audit findings. Web what happens after an irs audit? Form 4549 is based on the examiner's findings.

Taxpayer can agree with the irs or. Web the irs uses form 4549 for one of two reasons: Web form 4549, income tax examination changes, is used for cases that result in: Web what happens after an irs audit? Web form 4549 irs audit reconsideration: 1) to assess a tax for unfiled returns (sfr), 2) to reports its audit findings. Form 4549 is based on the examiner's findings. Normally, the irs will use the form for the initial.

Web Form 4549, Income Tax Examination Changes, Is Used For Cases That Result In:

Web what happens after an irs audit? 1) to assess a tax for unfiled returns (sfr), 2) to reports its audit findings. Normally, the irs will use the form for the initial. Form 4549 is based on the examiner's findings.

Web Form 4549 Irs Audit Reconsideration:

Taxpayer can agree with the irs or. Web the irs uses form 4549 for one of two reasons: