Form 5227 Efile

Form 5227 Efile - 9972) issued in february 2023, filers are required to file form 5227 electronically if. What is the form used for? Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227. Web to prepare form 5227 for 1041 returns, complete all applicable screens on the 5227 tab of the data entry menu.

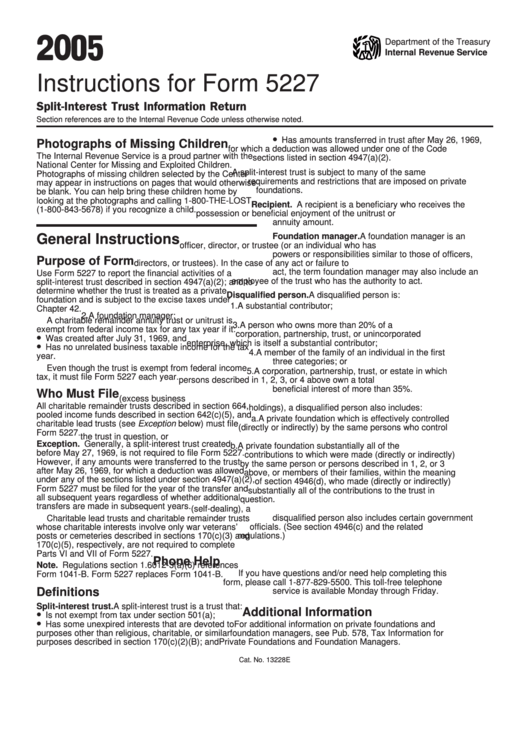

Instructions For Form 5227 printable pdf download

Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227. What is the form used for? 9972) issued in february 2023, filers are required to file form 5227 electronically if. Web to prepare form 5227 for 1041 returns, complete all applicable screens on the 5227 tab of the data entry menu.

Download Instructions for IRS Form 5227 SplitInterest Trust Information Return PDF, 2018

Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227. Web to prepare form 5227 for 1041 returns, complete all applicable screens on the 5227 tab of the data entry menu. What is the form used for? 9972) issued in february 2023, filers are required to file form 5227 electronically if.

Instructions For Form 5227 2016 printable pdf download

Web to prepare form 5227 for 1041 returns, complete all applicable screens on the 5227 tab of the data entry menu. 9972) issued in february 2023, filers are required to file form 5227 electronically if. What is the form used for? Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227.

Download Instructions for IRS Form 5227 SplitInterest Trust Information Return PDF, 2018

9972) issued in february 2023, filers are required to file form 5227 electronically if. What is the form used for? Web to prepare form 5227 for 1041 returns, complete all applicable screens on the 5227 tab of the data entry menu. Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227.

Instructions For Form 5227 printable pdf download

Web to prepare form 5227 for 1041 returns, complete all applicable screens on the 5227 tab of the data entry menu. Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227. What is the form used for? 9972) issued in february 2023, filers are required to file form 5227 electronically if.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

9972) issued in february 2023, filers are required to file form 5227 electronically if. Web to prepare form 5227 for 1041 returns, complete all applicable screens on the 5227 tab of the data entry menu. Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227. What is the form used for?

Instructions For Form 5227 printable pdf download

Web to prepare form 5227 for 1041 returns, complete all applicable screens on the 5227 tab of the data entry menu. 9972) issued in february 2023, filers are required to file form 5227 electronically if. Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227. What is the form used for?

5227 instructions Fill out & sign online DocHub

What is the form used for? 9972) issued in february 2023, filers are required to file form 5227 electronically if. Web to prepare form 5227 for 1041 returns, complete all applicable screens on the 5227 tab of the data entry menu. Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

What is the form used for? Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227. 9972) issued in february 2023, filers are required to file form 5227 electronically if. Web to prepare form 5227 for 1041 returns, complete all applicable screens on the 5227 tab of the data entry menu.

Download Instructions for IRS Form 5227 SplitInterest Trust Information Return PDF, 2022

9972) issued in february 2023, filers are required to file form 5227 electronically if. Web to prepare form 5227 for 1041 returns, complete all applicable screens on the 5227 tab of the data entry menu. Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227. What is the form used for?

What is the form used for? Web to prepare form 5227 for 1041 returns, complete all applicable screens on the 5227 tab of the data entry menu. 9972) issued in february 2023, filers are required to file form 5227 electronically if. Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227.

Web To Prepare Form 5227 For 1041 Returns, Complete All Applicable Screens On The 5227 Tab Of The Data Entry Menu.

9972) issued in february 2023, filers are required to file form 5227 electronically if. What is the form used for? Web you can electronically file a pooled income or charitable lead trust return with form 1041 and form 5227.