Form 8829 Example

Form 8829 Example - Expenses for business use of your home. Web information about form 8829, expenses for business use of your home, including recent updates, related forms. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover. Web learn about irs form 8829, including who qualifies and how to fill out this form to claim a home office deduction. File only with schedule c (form. Web department of the treasury internal revenue service. Web irs form 8829, titled “expenses for business use of your home,” is the tax form you use to claim the. Expenses for business use of your home. Web form 8829, expenses for business use of your home is the tax form that businesses use to itemize, calculate and claim their. Web what is irs form 8829:

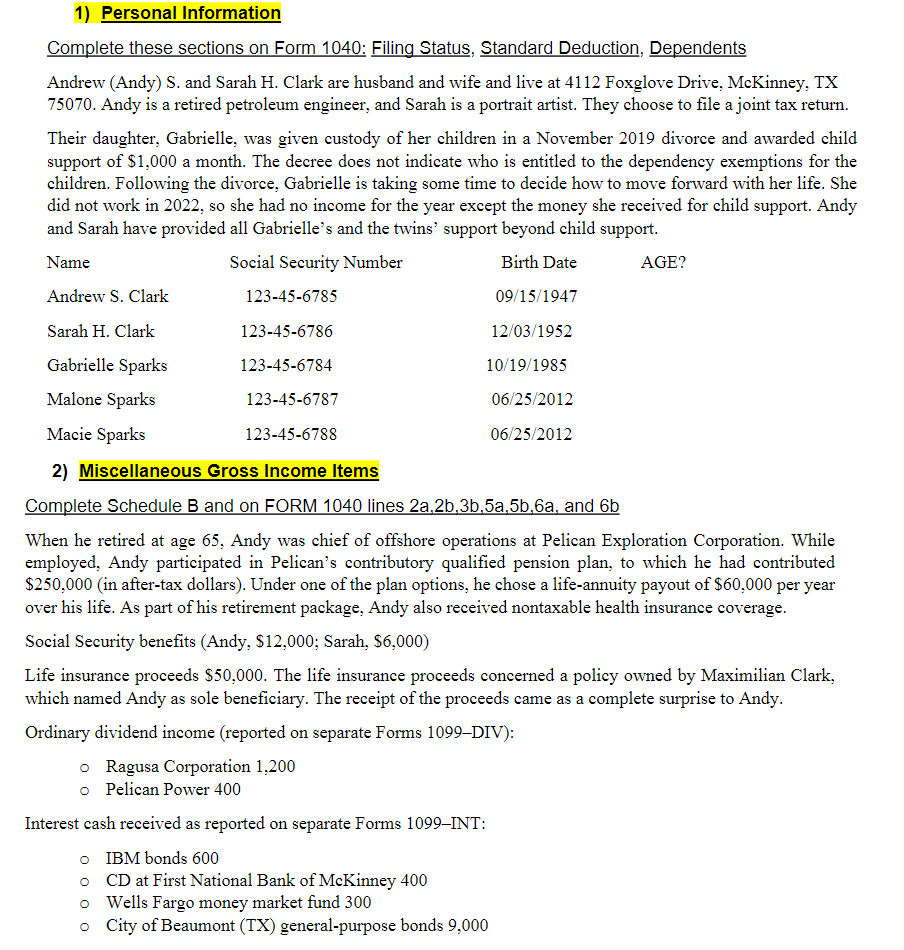

Home office tax deduction still available, just not for COVIDdisplaced employees working from

Web irs form 8829, titled “expenses for business use of your home,” is the tax form you use to claim the. Web information about form 8829, expenses for business use of your home, including recent updates, related forms. File only with schedule c (form. Web use form 8829 to figure the allowable expenses for business use of your home on.

Be sure to claim applicable household utility costs in your home office deduction Don't Mess

Web what is irs form 8829: Web learn about irs form 8829, including who qualifies and how to fill out this form to claim a home office deduction. Web department of the treasury internal revenue service. Expenses for business use of your home. Web information about form 8829, expenses for business use of your home, including recent updates, related forms.

Form 8829 Department of the Treasury Internal Revenue

File only with schedule c (form. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover. Expenses for business use of your home. Web learn about irs form 8829, including who qualifies and how to fill out this form to claim a home office deduction. Web department.

Fillable IRS Form 8829 2018 2019 Online PDF Template

File only with schedule c (form. Web department of the treasury internal revenue service. Web information about form 8829, expenses for business use of your home, including recent updates, related forms. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover. Web irs form 8829, titled “expenses.

Instructions For Form 8829 Expenses For Business Use Of Your Home 2012 printable pdf download

Web learn about irs form 8829, including who qualifies and how to fill out this form to claim a home office deduction. Web information about form 8829, expenses for business use of your home, including recent updates, related forms. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and.

Irs Form 8829 For 2022

Web information about form 8829, expenses for business use of your home, including recent updates, related forms. Expenses for business use of your home. Expenses for business use of your home. Web irs form 8829, titled “expenses for business use of your home,” is the tax form you use to claim the. File only with schedule c (form.

Form 8829 Instructions Your Complete Guide to Expense Your Home Office ZipBooks

Expenses for business use of your home. Written by a turbotax expert • reviewed by a turbotax cpa updated. Web what is irs form 8829: Web information about form 8829, expenses for business use of your home, including recent updates, related forms. Web irs form 8829, titled “expenses for business use of your home,” is the tax form you use.

Instructions For Form 8829 Expenses For Business Use Of Your Home 2017 printable pdf download

Web irs form 8829, titled “expenses for business use of your home,” is the tax form you use to claim the. Web information about form 8829, expenses for business use of your home, including recent updates, related forms. Expenses for business use of your home. File only with schedule c (form. Written by a turbotax expert • reviewed by a.

Form 8829 Expenses for Business Use of Your Home (2015) Free Download

Written by a turbotax expert • reviewed by a turbotax cpa updated. Web information about form 8829, expenses for business use of your home, including recent updates, related forms. Web learn about irs form 8829, including who qualifies and how to fill out this form to claim a home office deduction. Web department of the treasury internal revenue service. File.

Instructions For Form 8829 Expenses For Business Use Of Your Home 1999 printable pdf download

Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover. Web irs form 8829, titled “expenses for business use of your home,” is the tax form you use to claim the. Web information about form 8829, expenses for business use of your home, including recent updates, related.

Expenses for business use of your home. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover. Web what is irs form 8829: Written by a turbotax expert • reviewed by a turbotax cpa updated. Web information about form 8829, expenses for business use of your home, including recent updates, related forms. Web learn about irs form 8829, including who qualifies and how to fill out this form to claim a home office deduction. Web department of the treasury internal revenue service. Web form 8829, expenses for business use of your home is the tax form that businesses use to itemize, calculate and claim their. Expenses for business use of your home. File only with schedule c (form. Web irs form 8829, titled “expenses for business use of your home,” is the tax form you use to claim the.

File Only With Schedule C (Form.

Web what is irs form 8829: Web form 8829, expenses for business use of your home is the tax form that businesses use to itemize, calculate and claim their. Web information about form 8829, expenses for business use of your home, including recent updates, related forms. Written by a turbotax expert • reviewed by a turbotax cpa updated.

Web Use Form 8829 To Figure The Allowable Expenses For Business Use Of Your Home On Schedule C (Form 1040) And Any Carryover.

Expenses for business use of your home. Web learn about irs form 8829, including who qualifies and how to fill out this form to claim a home office deduction. Expenses for business use of your home. Web department of the treasury internal revenue service.