Form 8949 Code Eh

Form 8949 Code Eh - Use form 8949 to reconcile amounts that were. For a given tax year, the information on form 8949 covers all sales and exchanges of capital. Web form 8949 was designed for reporting capital gains and losses. Web form 8949 is used to report sales and exchanges of capital assets, such as stocks, bonds, real estate, or partnership. Web form 8949 is used to list all capital gain and loss transactions. Use form 8949 to report sales and exchanges of capital assets. Form 8949 allows you and the irs to reconcile. For most transactions, you don't need to complete. Web report the transaction on form 8949 as you would if you were the actual owner, but also enter any resulting gain as a negative. Web do not make entries directly on form 8949.

How to Fill Out Form 8949 for Cryptocurrency CoinLedger

Form 8949 allows you and the irs to reconcile. Web in this post, you'll learn key deadlines, filing instructions, and a walkthrough for completing form. Web form 8949 is used to list all capital gain and loss transactions. For a given tax year, the information on form 8949 covers all sales and exchanges of capital. Web form 8949 was designed.

Need To Report Cryptocurrency On Your Taxes? Here's How To Use Form 8949 To Do It Bankrate (2023)

Web form 8949 is used to report sales and exchanges of capital assets, such as stocks, bonds, real estate, or partnership. Web form 8949 was designed for reporting capital gains and losses. Use form 8949 to report sales and exchanges of capital assets. Web report the transaction on form 8949 as you would if you were the actual owner, but.

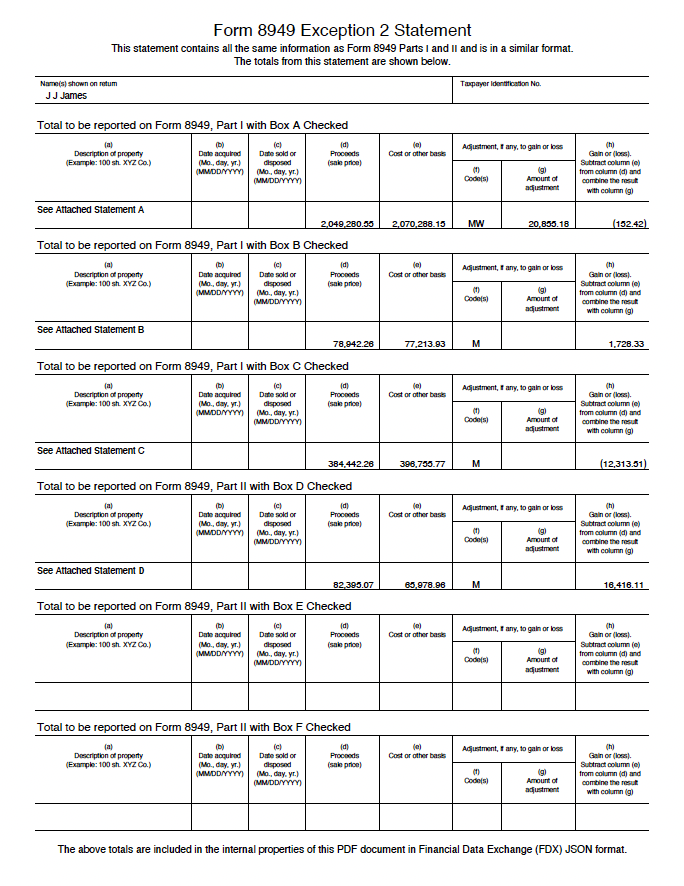

Form 8949 Exception 2 When Electronically Filing Form 1040

Web do not make entries directly on form 8949. Web report the transaction on form 8949 as you would if you were the actual owner, but also enter any resulting gain as a negative. For a given tax year, the information on form 8949 covers all sales and exchanges of capital. For most transactions, you don't need to complete. Web.

How to Import Intelligent Form 8949 Statements into Tax Software

For a given tax year, the information on form 8949 covers all sales and exchanges of capital. Web report the transaction on form 8949 as you would if you were the actual owner, but also enter any resulting gain as a negative. Web form 8949 is used to report sales and exchanges of capital assets, such as stocks, bonds, real.

Understanding IRS Form 8949 Instructions

Web in this post, you'll learn key deadlines, filing instructions, and a walkthrough for completing form. Web do not make entries directly on form 8949. Form 8949 allows you and the irs to reconcile. Web form 8949 is used to list all capital gain and loss transactions. Web report the transaction on form 8949 as you would if you were.

How to Fill Out Form 8949 for Cryptocurrency (Updated 2024)

For a given tax year, the information on form 8949 covers all sales and exchanges of capital. Web form 8949 was designed for reporting capital gains and losses. Web form 8949 is used to report sales and exchanges of capital assets, such as stocks, bonds, real estate, or partnership. Web in this post, you'll learn key deadlines, filing instructions, and.

IRS Form 8949 Instructions

Web form 8949 is used to report sales and exchanges of capital assets, such as stocks, bonds, real estate, or partnership. Form 8949 allows you and the irs to reconcile. Web report the transaction on form 8949 as you would if you were the actual owner, but also enter any resulting gain as a negative. For a given tax year,.

IRS Form 8949 Instructions Sales & Dispositions of Capital Assets

Web in this post, you'll learn key deadlines, filing instructions, and a walkthrough for completing form. Use form 8949 to report sales and exchanges of capital assets. Use form 8949 to reconcile amounts that were. For a given tax year, the information on form 8949 covers all sales and exchanges of capital. Web report the transaction on form 8949 as.

IRS Form 8949 (2022) > Federal 8949 Tax Form Printable Instructions & PDF to Fill Out Online

Form 8949 allows you and the irs to reconcile. Web report the transaction on form 8949 as you would if you were the actual owner, but also enter any resulting gain as a negative. Use form 8949 to reconcile amounts that were. Web do not make entries directly on form 8949. For a given tax year, the information on form.

IRS Form 8949 Instructions

For a given tax year, the information on form 8949 covers all sales and exchanges of capital. Web form 8949 is used to list all capital gain and loss transactions. For most transactions, you don't need to complete. Web form 8949 was designed for reporting capital gains and losses. Web do not make entries directly on form 8949.

Web form 8949 was designed for reporting capital gains and losses. For most transactions, you don't need to complete. Form 8949 allows you and the irs to reconcile. Web do not make entries directly on form 8949. Use form 8949 to reconcile amounts that were. For a given tax year, the information on form 8949 covers all sales and exchanges of capital. Web report the transaction on form 8949 as you would if you were the actual owner, but also enter any resulting gain as a negative. Use form 8949 to report sales and exchanges of capital assets. Web form 8949 is used to list all capital gain and loss transactions. Web in this post, you'll learn key deadlines, filing instructions, and a walkthrough for completing form. Web form 8949 is used to report sales and exchanges of capital assets, such as stocks, bonds, real estate, or partnership.

Web In This Post, You'll Learn Key Deadlines, Filing Instructions, And A Walkthrough For Completing Form.

For most transactions, you don't need to complete. Web form 8949 is used to list all capital gain and loss transactions. Use form 8949 to report sales and exchanges of capital assets. Web form 8949 is used to report sales and exchanges of capital assets, such as stocks, bonds, real estate, or partnership.

Use Form 8949 To Reconcile Amounts That Were.

Web report the transaction on form 8949 as you would if you were the actual owner, but also enter any resulting gain as a negative. Web do not make entries directly on form 8949. For a given tax year, the information on form 8949 covers all sales and exchanges of capital. Form 8949 allows you and the irs to reconcile.

.jpeg)