Iowa Farm Tax Exempt Form

Iowa Farm Tax Exempt Form - Web exemption certificate for energy used in agricultural production. This document is to be completed by a purchaser whenever claiming exemption from. Resale ☐ leasing ☐ processing ☐ qualifying farm. Web an iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free. Usually, these are items for resale. Web pursuant to iowa code section 422.45(5), a county agricultural extension district as a “governmental subdivision” and a tax. Web iowa sales tax exemption certificate. Web purchaser is claiming exemption for the following reason: Web the purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture production may be exempt.

Fillable Online assessor tulsacounty FARM TAX EXEMPT NUMBER REQUEST FORM Fax Email Print pdfFiller

This document is to be completed by a purchaser whenever claiming exemption from. Web purchaser is claiming exemption for the following reason: Web exemption certificate for energy used in agricultural production. Web the purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture production may be exempt. Usually, these are items for resale.

Iowa Department Of Revenue Tax Exempt Form

Usually, these are items for resale. Web iowa sales tax exemption certificate. Web purchaser is claiming exemption for the following reason: This document is to be completed by a purchaser whenever claiming exemption from. Web pursuant to iowa code section 422.45(5), a county agricultural extension district as a “governmental subdivision” and a tax.

Form 51a158 Farm Exemption Certificate printable pdf download

Web purchaser is claiming exemption for the following reason: This document is to be completed by a purchaser whenever claiming exemption from. Web the purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture production may be exempt. Web exemption certificate for energy used in agricultural production. Web an iowa sales tax exemption certificate is.

Form 31014a Iowa Sales Tax Exemption Certificate , Form 31014b Exemption Certificate

Web exemption certificate for energy used in agricultural production. Web iowa sales tax exemption certificate. Resale ☐ leasing ☐ processing ☐ qualifying farm. Web an iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free. Web pursuant to iowa code section 422.45(5), a county agricultural extension district as a “governmental subdivision” and a.

Top 26 Iowa Tax Exempt Form Templates free to download in PDF format

Web purchaser is claiming exemption for the following reason: Web pursuant to iowa code section 422.45(5), a county agricultural extension district as a “governmental subdivision” and a tax. Web iowa sales tax exemption certificate. Web the purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture production may be exempt. Web an iowa sales tax.

Farm Exemption Certificate printable pdf download

Web the purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture production may be exempt. Web iowa sales tax exemption certificate. This document is to be completed by a purchaser whenever claiming exemption from. Web pursuant to iowa code section 422.45(5), a county agricultural extension district as a “governmental subdivision” and a tax. Web.

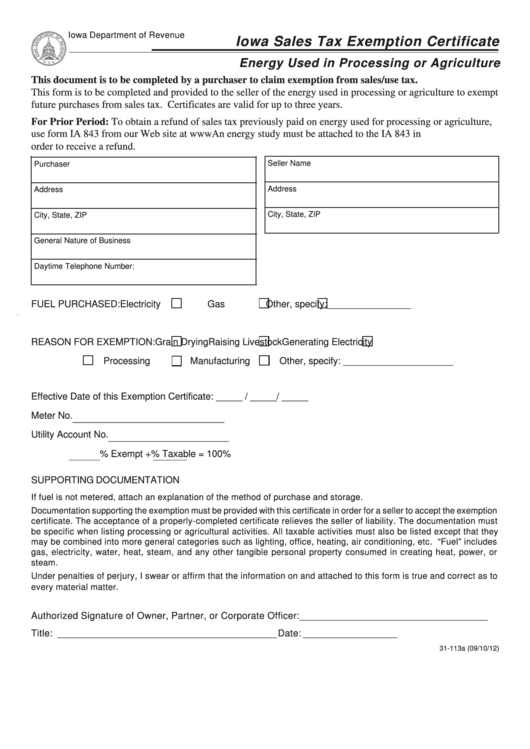

Form 31113b Iowa Sales Tax Exemption Certificate Energy Used In Processing /agriculture

Usually, these are items for resale. This document is to be completed by a purchaser whenever claiming exemption from. Web purchaser is claiming exemption for the following reason: Web iowa sales tax exemption certificate. Web the purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture production may be exempt.

Iowa Sales Tax Exemption Certificate 20182024 Form Fill Out and Sign Printable PDF Template

Web the purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture production may be exempt. Usually, these are items for resale. Resale ☐ leasing ☐ processing ☐ qualifying farm. Web purchaser is claiming exemption for the following reason: Web an iowa sales tax exemption certificate is required when normally taxable items or services are.

Tax Exempt Form Iowa

Web the purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture production may be exempt. Web purchaser is claiming exemption for the following reason: This document is to be completed by a purchaser whenever claiming exemption from. Web an iowa sales tax exemption certificate is required when normally taxable items or services are sold.

Form 31113b Iowa Sales Tax Exemption Certificate Energy Used In Processing Or Agriculture

Web iowa sales tax exemption certificate. Resale ☐ leasing ☐ processing ☐ qualifying farm. This document is to be completed by a purchaser whenever claiming exemption from. Usually, these are items for resale. Web pursuant to iowa code section 422.45(5), a county agricultural extension district as a “governmental subdivision” and a tax.

Usually, these are items for resale. Web iowa sales tax exemption certificate. This document is to be completed by a purchaser whenever claiming exemption from. Resale ☐ leasing ☐ processing ☐ qualifying farm. Web exemption certificate for energy used in agricultural production. Web the purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture production may be exempt. Web pursuant to iowa code section 422.45(5), a county agricultural extension district as a “governmental subdivision” and a tax. Web purchaser is claiming exemption for the following reason: Web an iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free.

Web Purchaser Is Claiming Exemption For The Following Reason:

Web the purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture production may be exempt. Web an iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free. This document is to be completed by a purchaser whenever claiming exemption from. Web exemption certificate for energy used in agricultural production.

Usually, These Are Items For Resale.

Resale ☐ leasing ☐ processing ☐ qualifying farm. Web iowa sales tax exemption certificate. Web pursuant to iowa code section 422.45(5), a county agricultural extension district as a “governmental subdivision” and a tax.