Iowa Homestead Tax Credit And Exemption Form

Iowa Homestead Tax Credit And Exemption Form - Web for the assessment year beginning on january 1, 2023, the exemption is for $3,250 of taxable value. This tax credit continues as. Notice of transfer or change in use of property. Web the department recently announced through a news release the availability of the new homestead exemption. Web homestead tax credit and exemption. Families/households with more than 8 persons, add $11,800 for each additional person. Iowa code chapter 425 and iowa administrative code rule 701—110.1 this application. Return the form to your city or county assessor. The department is excited to announce our.

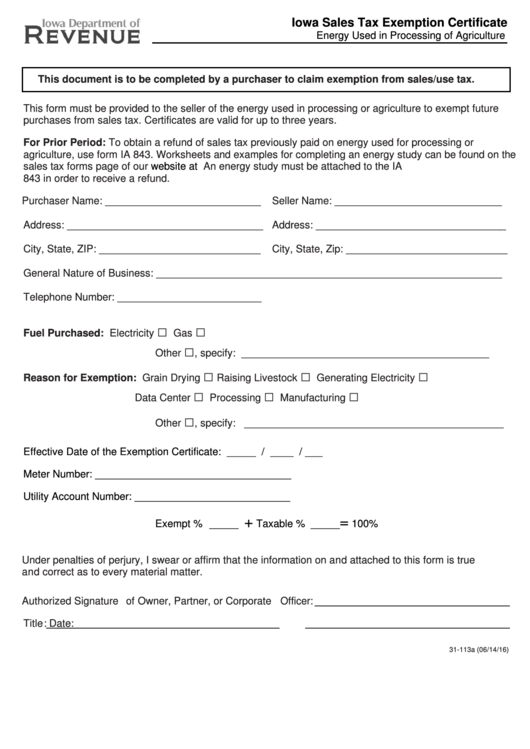

Iowa Sales Tax Exemption Certificate Form Iowa Department Of Revenue printable pdf download

Iowa code chapter 425 and iowa administrative code rule 701—110.1 this application. Notice of transfer or change in use of property. Web the department recently announced through a news release the availability of the new homestead exemption. The department is excited to announce our. This tax credit continues as.

How To Get An Iowa Sales Tax Exemption Certificate StartUp 101

Families/households with more than 8 persons, add $11,800 for each additional person. Web homestead tax credit and exemption. Web the department recently announced through a news release the availability of the new homestead exemption. The department is excited to announce our. Iowa code chapter 425 and iowa administrative code rule 701—110.1 this application.

Homestead exemption form

This tax credit continues as. Families/households with more than 8 persons, add $11,800 for each additional person. Web the department recently announced through a news release the availability of the new homestead exemption. Web homestead tax credit and exemption. Iowa code chapter 425 and iowa administrative code rule 701—110.1 this application.

Iowa sales tax exemption certificate Fill out & sign online DocHub

This tax credit continues as. Return the form to your city or county assessor. Web for the assessment year beginning on january 1, 2023, the exemption is for $3,250 of taxable value. Iowa code chapter 425 and iowa administrative code rule 701—110.1 this application. Families/households with more than 8 persons, add $11,800 for each additional person.

Form 54028 Download Fillable PDF or Fill Online Homestead Tax Credit and Exemption, Iowa

Notice of transfer or change in use of property. Web for the assessment year beginning on january 1, 2023, the exemption is for $3,250 of taxable value. The department is excited to announce our. Web homestead tax credit and exemption. Iowa code chapter 425 and iowa administrative code rule 701—110.1 this application.

Application Form For Homestead Tax Credit printable pdf download

The department is excited to announce our. Notice of transfer or change in use of property. Families/households with more than 8 persons, add $11,800 for each additional person. Web the department recently announced through a news release the availability of the new homestead exemption. This tax credit continues as.

Form 54028 Download Fillable PDF or Fill Online Homestead Tax Credit and Exemption, Iowa

The department is excited to announce our. Web for the assessment year beginning on january 1, 2023, the exemption is for $3,250 of taxable value. Notice of transfer or change in use of property. This tax credit continues as. Return the form to your city or county assessor.

Homestead Exemption Application for 65+ Cedar County, Iowa

Web for the assessment year beginning on january 1, 2023, the exemption is for $3,250 of taxable value. Return the form to your city or county assessor. The department is excited to announce our. Web homestead tax credit and exemption. This tax credit continues as.

Application For Homestead Property Tax Exemption Form printable pdf download

Web homestead tax credit and exemption. Web for the assessment year beginning on january 1, 2023, the exemption is for $3,250 of taxable value. Return the form to your city or county assessor. Notice of transfer or change in use of property. Families/households with more than 8 persons, add $11,800 for each additional person.

SC Application For Homestead Exemption Fill And Sign Printable

Web homestead tax credit and exemption. The department is excited to announce our. Iowa code chapter 425 and iowa administrative code rule 701—110.1 this application. Web for the assessment year beginning on january 1, 2023, the exemption is for $3,250 of taxable value. Families/households with more than 8 persons, add $11,800 for each additional person.

Iowa code chapter 425 and iowa administrative code rule 701—110.1 this application. This tax credit continues as. Web for the assessment year beginning on january 1, 2023, the exemption is for $3,250 of taxable value. Web the department recently announced through a news release the availability of the new homestead exemption. Families/households with more than 8 persons, add $11,800 for each additional person. Notice of transfer or change in use of property. Return the form to your city or county assessor. Web homestead tax credit and exemption. The department is excited to announce our.

The Department Is Excited To Announce Our.

This tax credit continues as. Notice of transfer or change in use of property. Web the department recently announced through a news release the availability of the new homestead exemption. Return the form to your city or county assessor.

Web Homestead Tax Credit And Exemption.

Families/households with more than 8 persons, add $11,800 for each additional person. Iowa code chapter 425 and iowa administrative code rule 701—110.1 this application. Web for the assessment year beginning on january 1, 2023, the exemption is for $3,250 of taxable value.