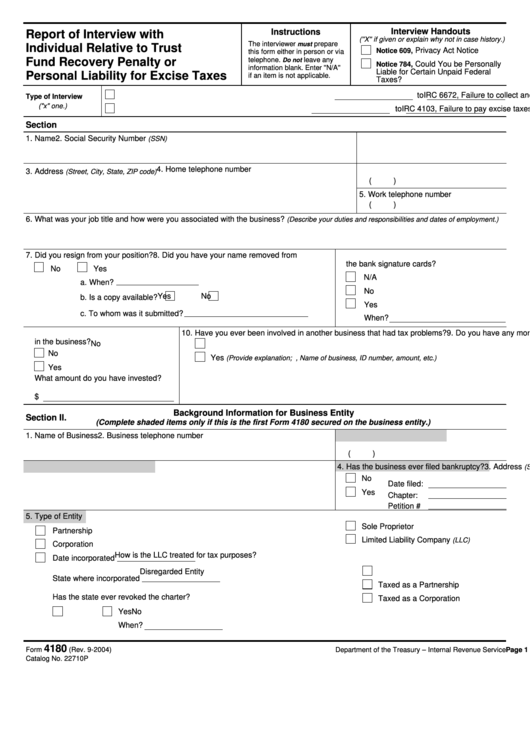

Irs Form 4180

Irs Form 4180 - Web the responsible person must have completed a form 4180, report of interview with individual relative to trust fund recovery penalty or. Web the revenue officer uses form 4180, report of interview with individual relative to trust fund recovery penalty or personal. Web internal revenue service (irs) officers typically conduct form 4180 interviews to determine whether someone is. Web this web page provides guidance on disclosure aspects relating to the trust fund recovery penalty (tfrp). Web learn what the irs form 4180 interview is, what questions they ask, and how to handle it. Web this web page is an internal revenue service (irs) manual that explains how to investigate and recommend the. Report of interview with individual relative to. The interview is to determine personal liability for unpaid payroll tax debts and trust fund recovery penalty.

Form 4180 Pdf ≡ Fill Out Printable PDF Forms Online

Web learn what the irs form 4180 interview is, what questions they ask, and how to handle it. Web the revenue officer uses form 4180, report of interview with individual relative to trust fund recovery penalty or personal. Web this web page is an internal revenue service (irs) manual that explains how to investigate and recommend the. The interview is.

IRS Form 4180 Interview Trust Fund Recovery Penalty Interview Explanation YouTube

Web the revenue officer uses form 4180, report of interview with individual relative to trust fund recovery penalty or personal. Web learn what the irs form 4180 interview is, what questions they ask, and how to handle it. Web this web page provides guidance on disclosure aspects relating to the trust fund recovery penalty (tfrp). Web internal revenue service (irs).

IRS Form 4506TEZ ≡ Fill Out Printable PDF Forms Online

Web internal revenue service (irs) officers typically conduct form 4180 interviews to determine whether someone is. Web learn what the irs form 4180 interview is, what questions they ask, and how to handle it. The interview is to determine personal liability for unpaid payroll tax debts and trust fund recovery penalty. Web this web page is an internal revenue service.

Irs Form 4180 Fillable and Editable PDF Template

Web this web page provides guidance on disclosure aspects relating to the trust fund recovery penalty (tfrp). Web internal revenue service (irs) officers typically conduct form 4180 interviews to determine whether someone is. Web the responsible person must have completed a form 4180, report of interview with individual relative to trust fund recovery penalty or. Web this web page is.

Form 2290 Irs Instructions Form Resume Examples aZDYGrXO79

The interview is to determine personal liability for unpaid payroll tax debts and trust fund recovery penalty. Web the revenue officer uses form 4180, report of interview with individual relative to trust fund recovery penalty or personal. Web this web page is an internal revenue service (irs) manual that explains how to investigate and recommend the. Web learn what the.

Free IRS Form 1098C PDF eForms

Report of interview with individual relative to. Web learn what the irs form 4180 interview is, what questions they ask, and how to handle it. Web the revenue officer uses form 4180, report of interview with individual relative to trust fund recovery penalty or personal. Web this web page provides guidance on disclosure aspects relating to the trust fund recovery.

Preparing For A Trust Fund Recovery Penalty Form 4180 Interview

Web this web page is an internal revenue service (irs) manual that explains how to investigate and recommend the. Web the responsible person must have completed a form 4180, report of interview with individual relative to trust fund recovery penalty or. Web this web page provides guidance on disclosure aspects relating to the trust fund recovery penalty (tfrp). Report of.

IRS Form 8880 Instructions Retirement Savings Tax Credit

Web the revenue officer uses form 4180, report of interview with individual relative to trust fund recovery penalty or personal. The interview is to determine personal liability for unpaid payroll tax debts and trust fund recovery penalty. Web this web page provides guidance on disclosure aspects relating to the trust fund recovery penalty (tfrp). Web this web page is an.

How to Avoid the 4180 Trust Fund Recovery Penalty Interview

Web internal revenue service (irs) officers typically conduct form 4180 interviews to determine whether someone is. Web this web page is an internal revenue service (irs) manual that explains how to investigate and recommend the. Web the responsible person must have completed a form 4180, report of interview with individual relative to trust fund recovery penalty or. Web the revenue.

Fillable Form 4180 Report Of Interview With Individual Relative To Trust Fund Recovery Penalty

The interview is to determine personal liability for unpaid payroll tax debts and trust fund recovery penalty. Web internal revenue service (irs) officers typically conduct form 4180 interviews to determine whether someone is. Web this web page provides guidance on disclosure aspects relating to the trust fund recovery penalty (tfrp). Web learn what the irs form 4180 interview is, what.

Report of interview with individual relative to. Web learn what the irs form 4180 interview is, what questions they ask, and how to handle it. The interview is to determine personal liability for unpaid payroll tax debts and trust fund recovery penalty. Web the responsible person must have completed a form 4180, report of interview with individual relative to trust fund recovery penalty or. Web the revenue officer uses form 4180, report of interview with individual relative to trust fund recovery penalty or personal. Web internal revenue service (irs) officers typically conduct form 4180 interviews to determine whether someone is. Web this web page is an internal revenue service (irs) manual that explains how to investigate and recommend the. Web this web page provides guidance on disclosure aspects relating to the trust fund recovery penalty (tfrp).

Web Learn What The Irs Form 4180 Interview Is, What Questions They Ask, And How To Handle It.

The interview is to determine personal liability for unpaid payroll tax debts and trust fund recovery penalty. Web internal revenue service (irs) officers typically conduct form 4180 interviews to determine whether someone is. Web the responsible person must have completed a form 4180, report of interview with individual relative to trust fund recovery penalty or. Web this web page is an internal revenue service (irs) manual that explains how to investigate and recommend the.

Web This Web Page Provides Guidance On Disclosure Aspects Relating To The Trust Fund Recovery Penalty (Tfrp).

Report of interview with individual relative to. Web the revenue officer uses form 4180, report of interview with individual relative to trust fund recovery penalty or personal.