N-15 Form

N-15 Form - 2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. Web 87 rows any person who is not required to register as a “verified practitioner” must use their full social security number on form n. 2014) art c 2014 or nol ear t thru for office use only b. Web form state of hawaii department of taxation 1 t (rev.

20202022 Form HI DoT N288C Fill Online, Printable, Fillable, Blank pdfFiller

2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. Web 87 rows any person who is not required to register as a “verified practitioner” must use their full social security number on form n. 2014) art c 2014 or nol ear t thru for office use only.

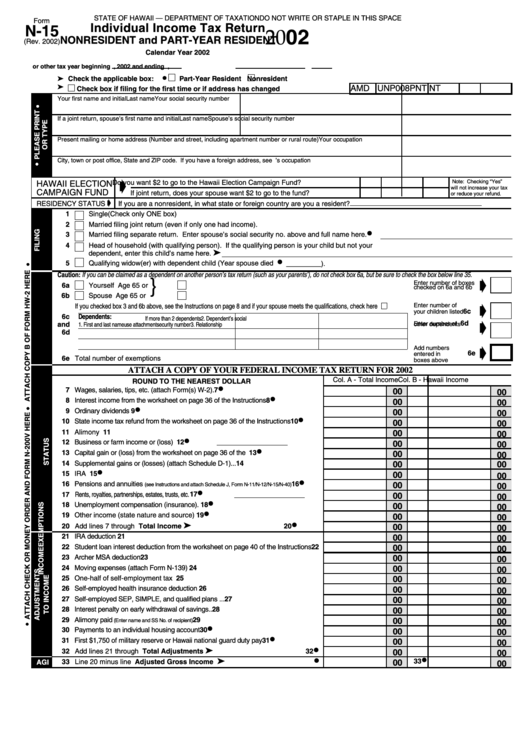

Fillable Form N15 Individual Tax Return Nonresident And PartYear Resident State Of

Web 87 rows any person who is not required to register as a “verified practitioner” must use their full social security number on form n. 2014) art c 2014 or nol ear t thru for office use only b. Web form state of hawaii department of taxation 1 t (rev. 2020) page 3 of 4 38 if you do not.

PPT to GWRRA Rider Education’s PowerPoint Presentation, free download ID6665996

Web form state of hawaii department of taxation 1 t (rev. 2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. Web 87 rows any person who is not required to register as a “verified practitioner” must use their full social security number on form n. 2014) art.

Form N11 (N15) Schedule X 2019 Fill Out, Sign Online and Download Fillable PDF, Hawaii

2014) art c 2014 or nol ear t thru for office use only b. Web 87 rows any person who is not required to register as a “verified practitioner” must use their full social security number on form n. Web form state of hawaii department of taxation 1 t (rev. 2020) page 3 of 4 38 if you do not.

15 Document Form Fill Out and Sign Printable PDF Template signNow

2014) art c 2014 or nol ear t thru for office use only b. 2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. Web form state of hawaii department of taxation 1 t (rev. Web 87 rows any person who is not required to register as a.

NI15 Employment Identity Document

2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. Web form state of hawaii department of taxation 1 t (rev. Web 87 rows any person who is not required to register as a “verified practitioner” must use their full social security number on form n. 2014) art.

Form N15 Individual Tax ReturnNonresident And PartYear Resident 2002 printable pdf

Web form state of hawaii department of taxation 1 t (rev. 2014) art c 2014 or nol ear t thru for office use only b. Web 87 rows any person who is not required to register as a “verified practitioner” must use their full social security number on form n. 2020) page 3 of 4 38 if you do not.

Fillable Form N11/n13/n15 Schedule X Tax Credits For Hawaii Residents 2010 printable

Web 87 rows any person who is not required to register as a “verified practitioner” must use their full social security number on form n. 2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. Web form state of hawaii department of taxation 1 t (rev. 2014) art.

Download New 15G 15 H Forms

Web form state of hawaii department of taxation 1 t (rev. 2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. 2014) art c 2014 or nol ear t thru for office use only b. Web 87 rows any person who is not required to register as a.

Form N15 Exercise University of Hawaii J1 State of Hawaii Tax March 18, ppt download

Web form state of hawaii department of taxation 1 t (rev. 2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. Web 87 rows any person who is not required to register as a “verified practitioner” must use their full social security number on form n. 2014) art.

Web form state of hawaii department of taxation 1 t (rev. Web 87 rows any person who is not required to register as a “verified practitioner” must use their full social security number on form n. 2014) art c 2014 or nol ear t thru for office use only b. 2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a.

2014) Art C 2014 Or Nol Ear T Thru For Office Use Only B.

Web form state of hawaii department of taxation 1 t (rev. Web 87 rows any person who is not required to register as a “verified practitioner” must use their full social security number on form n. 2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a.