Robinhood Form 8949

Robinhood Form 8949 - Web easier tax filing with a document id. Web form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made. If you sold stock at a loss, you can use the. Select account (person icon) → menu (3 bars) (on the web skip to the next step). Web use form 8949 to report sales and exchanges of capital assets. Web on form 8949 you’ll be able to determine your initial capital gains or losses. Form 8949 allows you and the irs to reconcile. Here’s how to fill out. Web net gain or loss: Total gain or loss of all positions sold during the tax year per form 8949 category

IRS Form 8949 Instructions

Web easier tax filing with a document id. Web all your tax documents are located in the tax center: Here’s how to fill out. Report your robinhood income on schedule d and fill out form 8949. Web use form 8949 to report sales and exchanges of capital assets.

What is the IRS Form 8949 and Do You Need It? The Handy Tax Guy

Web use form 8949 to report sales and exchanges of capital assets. Web on form 8949 you’ll be able to determine your initial capital gains or losses. Here’s how to fill out. Web net gain or loss: You’ll be able to use the document id from your combined pdf to.

Form 8949 and Sch. D diagrams I exercised my ISOs and sold the ISO stock later in the same year

Total gain or loss of all positions sold during the tax year per form 8949 category Web form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made. You’ll be able to use the document id from your combined pdf to. Web all your tax documents are located.

Form 8949 Fillable and Editable Digital Blanks in PDF

If you sold stock at a loss, you can use the. Web net gain or loss: Report your robinhood income on schedule d and fill out form 8949. Form 8949 allows you and the irs to reconcile. Total gain or loss of all positions sold during the tax year per form 8949 category

IRS Form 8949 Instructions

Form 8949 allows you and the irs to reconcile. Here’s how to fill out. Web use form 8949 to report sales and exchanges of capital assets. Web net gain or loss: Web all your tax documents are located in the tax center:

IRS Form 8949 Instructions

Web use form 8949 to report sales and exchanges of capital assets. If you sold stock at a loss, you can use the. Total gain or loss of all positions sold during the tax year per form 8949 category Select account (person icon) → menu (3 bars) (on the web skip to the next step). Report your robinhood income on.

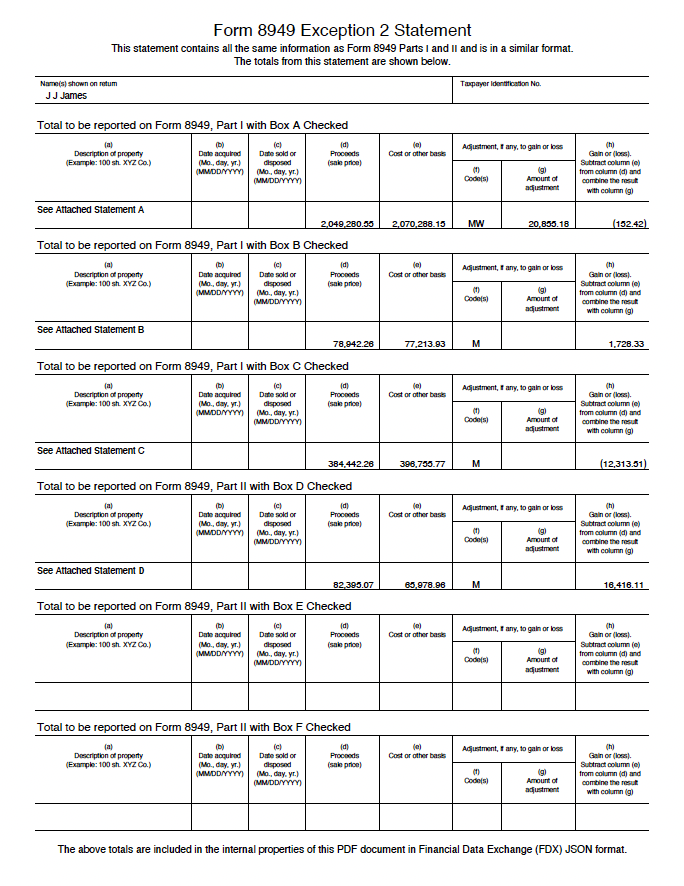

Explanation of IRS Form 8949 Exception 2

Total gain or loss of all positions sold during the tax year per form 8949 category Web net gain or loss: If you sold stock at a loss, you can use the. Web on form 8949 you’ll be able to determine your initial capital gains or losses. Web form 8949 is used to report the “sales and dispositions of capital.

Robinhood Tax Loss on Form 8949 YouTube

Web on form 8949 you’ll be able to determine your initial capital gains or losses. Web form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made. Select account (person icon) → menu (3 bars) (on the web skip to the next step). Web all your tax documents.

Explanation of IRS Form 8949 Exception 2

Web form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made. Report your robinhood income on schedule d and fill out form 8949. Web all your tax documents are located in the tax center: Total gain or loss of all positions sold during the tax year per.

IRS Form 8949 Instructions Sales & Dispositions of Capital Assets

Here’s how to fill out. Web form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made. Form 8949 allows you and the irs to reconcile. Web all your tax documents are located in the tax center: If you sold stock at a loss, you can use the.

Form 8949 allows you and the irs to reconcile. If you sold stock at a loss, you can use the. Web all your tax documents are located in the tax center: Select account (person icon) → menu (3 bars) (on the web skip to the next step). Total gain or loss of all positions sold during the tax year per form 8949 category Report your robinhood income on schedule d and fill out form 8949. Web easier tax filing with a document id. Web use form 8949 to report sales and exchanges of capital assets. Web on form 8949 you’ll be able to determine your initial capital gains or losses. Web form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made. Web net gain or loss: You’ll be able to use the document id from your combined pdf to. Here’s how to fill out.

Web Use Form 8949 To Report Sales And Exchanges Of Capital Assets.

Web on form 8949 you’ll be able to determine your initial capital gains or losses. Select account (person icon) → menu (3 bars) (on the web skip to the next step). Report your robinhood income on schedule d and fill out form 8949. You’ll be able to use the document id from your combined pdf to.

Here’s How To Fill Out.

If you sold stock at a loss, you can use the. Form 8949 allows you and the irs to reconcile. Web all your tax documents are located in the tax center: Web easier tax filing with a document id.

Web Net Gain Or Loss:

Total gain or loss of all positions sold during the tax year per form 8949 category Web form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made.