Turbotax Form 5329

Turbotax Form 5329 - Web in this article, you'll find answers to frequently asked questions on retirement plan taxes (form 5329). Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2. Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including iras and other. Iras, other qualified retirement plans, modified endowment contracts, coverdell. Web use form 5329 to report additional taxes on: The form is filled out and submitted by the. Learn how to file, what to report, and get the.

5329 Additional Taxes on Qualified Plans UltimateTax Solution Center

The form is filled out and submitted by the. Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2. Iras, other qualified retirement plans, modified endowment contracts, coverdell. Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including iras and other. Web in this.

Form 5329 turbotax Fill out & sign online DocHub

Learn how to file, what to report, and get the. Iras, other qualified retirement plans, modified endowment contracts, coverdell. Web in this article, you'll find answers to frequently asked questions on retirement plan taxes (form 5329). Web use form 5329 to report additional taxes on: Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including.

How do I include form 5329 when I efile with TurboTax? Page 2

Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2. Web use form 5329 to report additional taxes on: Iras, other qualified retirement plans, modified endowment contracts, coverdell. Web in this article, you'll find answers to frequently asked questions on retirement plan taxes (form 5329). Web the irs uses.

How can I edit form 5329? TurboTax doesn't have the correct values in it.

Learn how to file, what to report, and get the. Web use form 5329 to report additional taxes on: The form is filled out and submitted by the. Iras, other qualified retirement plans, modified endowment contracts, coverdell. Web in this article, you'll find answers to frequently asked questions on retirement plan taxes (form 5329).

Fill Free fillable Form 5329 2019 Additional Taxes on Qualified Plans PDF form

Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including iras and other. Web in this article, you'll find answers to frequently asked questions on retirement plan taxes (form 5329). The form is filled out and submitted by the. Learn how to file, what to report, and get the. Iras, other qualified retirement plans, modified.

IRS Form 5329 Explained How to Navigate Retirement Account Penalty Exemptions?

Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including iras and other. Learn how to file, what to report, and get the. The form is filled out and submitted by the. Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2. Web in.

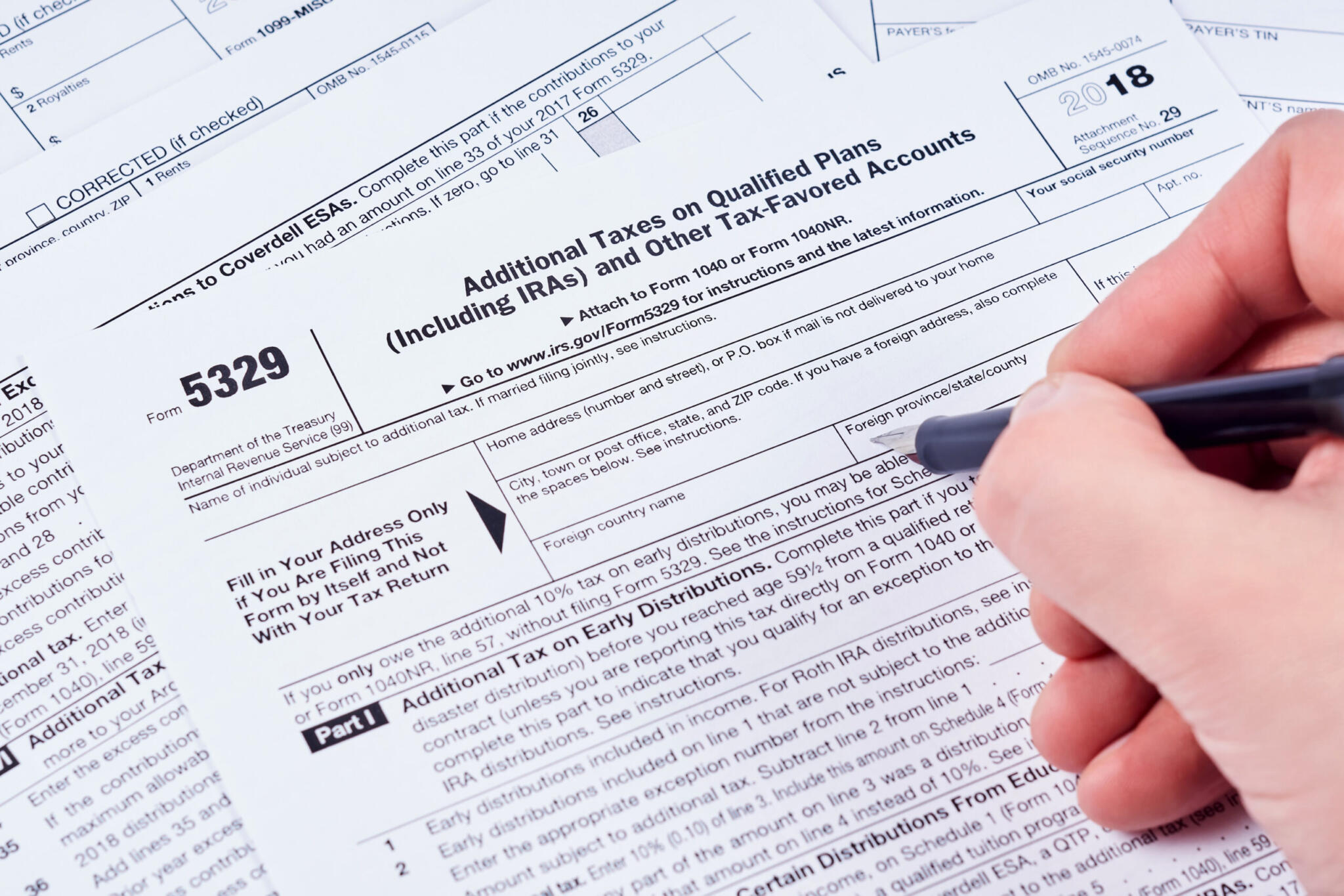

IRS Form 5329 Download Fillable PDF or Fill Online Additional Taxes on Qualified Plans

Iras, other qualified retirement plans, modified endowment contracts, coverdell. Web use form 5329 to report additional taxes on: The form is filled out and submitted by the. Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including iras and other. Web in this article, you'll find answers to frequently asked questions on retirement plan taxes.

Solved Where is the form 5329 on TurboTax?

Learn how to file, what to report, and get the. Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including iras and other. Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2. Web use form 5329 to report additional taxes on: Iras, other.

IRS Form 5329 [For Retirement Savings And More] Tax Relief Center

The form is filled out and submitted by the. Web use form 5329 to report additional taxes on: Iras, other qualified retirement plans, modified endowment contracts, coverdell. Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2. Web the irs uses form 5329 to report additional taxes on qualified.

Instructions for How to Fill in IRS Form 5329

Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2. The form is filled out and submitted by the. Web use form 5329 to report additional taxes on: Learn how to file, what to report, and get the. Web the irs uses form 5329 to report additional taxes on.

Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2. Learn how to file, what to report, and get the. Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including iras and other. The form is filled out and submitted by the. Iras, other qualified retirement plans, modified endowment contracts, coverdell. Web in this article, you'll find answers to frequently asked questions on retirement plan taxes (form 5329). Web use form 5329 to report additional taxes on:

The Form Is Filled Out And Submitted By The.

Web use form 5329 to report additional taxes on: Iras, other qualified retirement plans, modified endowment contracts, coverdell. Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2. Web the irs uses form 5329 to report additional taxes on qualified retirement plans, including iras and other.

Learn How To File, What To Report, And Get The.

Web in this article, you'll find answers to frequently asked questions on retirement plan taxes (form 5329).

![IRS Form 5329 [For Retirement Savings And More] Tax Relief Center](https://i2.wp.com/help.taxreliefcenter.org/wp-content/uploads/2019/07/TRC-PIN-IRS-Form-5329.png)